President Trump calls tariffs ‘medicine’ as stock market plunges

President Donald Trump spent the weekend at a golf tournament in Florida as the stock market continued to plunge.

As the stocks continue to dip Monday, some business leaders are weighing in on President Donald Trump’s widespread tariff orders and their impact on the market.

Stocks fell sharply at Monday’s opening bell before seesawing throughout the morning. The Dow, the S&P 500 and the Nasdaq were all lower by 3:25 p.m. ET Monday.

Trump has tried to assure Americans that the tariffs would accomplish his trade goals and told them to be patient. But key finance figures, and even some of his closest allies, have criticized the latest round of tariffs as global stock markets have plunged.

Here’s a look at what some financial leaders have said about tariffs:

Bill Ackman: ‘We are heading for a self-induced, economic nuclear winter’

Bill Ackman, a hedge fund manager who previously endorsed Trump, took to X on Sunday to call on Trump to hit pause on the tariffs

“The country is 100% behind the president on fixing a global system of tariffs that has disadvantaged the country. But, business is a confidence game and confidence depends on trust,” his post said.

“By placing massive and disproportionate tariffs on our friends and our enemies alike and thereby launching a global economic war against the whole world at once, we are in the process of destroying confidence in our country as a trading partner, as a place to do business, and as a market to invest capital.”

Jamie Dimon says tariffs will lead to slower economic growth in the short term

Jamie Dimon, the CEO of JPMorganChase and a prominent voice on Wall Street, addressed the tariffs in a Monday letter to shareholders.

“The recent tariffs will likely increase inflation and are causing many to consider a greater probability of a recession,” the letter read.

He said there may be some legitimate reasons for the recent tariff announcements, and the long-term effects could be affected by several factors. Regardless, they are likely to cause inflation and slower economic growth in the short term, he said.

He acknowledged the U.S. spending deficit is unsustainable, and also expressed faith in the resilience of the American economy.

“I am hoping that after negotiations, the long-term effect will have some positive benefits for the United States,” Dimon’s letter read. “My most serious concern is how this will affect America’s long-term economic alliances.”

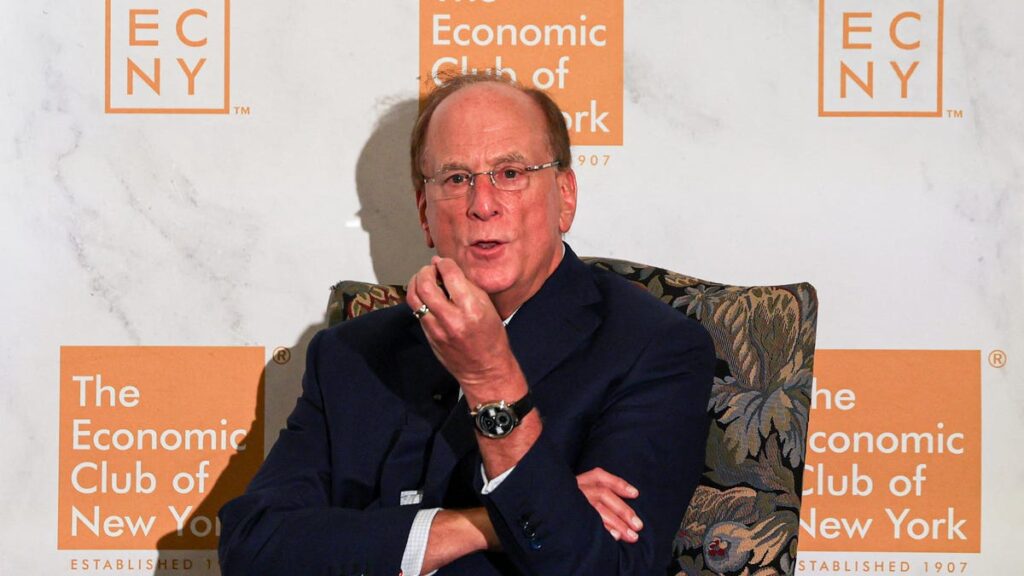

Larry Fink cautions about inflation, warns of continued stock market drop

Larry Fink, Chair and CEO of the world’s biggest asset management firm BlackRock, spoke about tariffs and the stock market at an Economic Club of New York event Monday.

Fink said he is worried about inflation if tariffs hold, according to the club’s coverage of the event on X. However, he noted Trump’s tariffs could be successful in changing the behaviors of other countries’ trade policies.

Trump later told reporters he was not considering pausing tariffs but was open to negotiate the rates with other countries.

Fink also said the weakened stock market is “more of a buying opportunity than a selling opportunity” in the long run, according to Reuters. Though he added that markets could decline another 20%.

Elon Musk signals criticism for Trump tariffs

The world’s richest man, top Trump campaign donor and leader of the Department of Government Efficiency, criticized Trump’s top trade adviser Peter Navarro over the weekend over his Harvard credentials.

Then on Monday, Musk shared an explanatory video that promoted free trade. While it was not a direct criticism of Trump’s tariffs, the post drew attention due to the timing.

Contributing: Zac Anderson, John Bacon, Joey Garrison; Reuters

Kinsey Crowley is a trending news reporter at USA TODAY. Reach her at kcrowley@gannett.com. Follow her on X and TikTok @kinseycrowley or Bluesky at @kinseycrowley.bsky.social.